We have Key Themes that drive our strategy for Portfolio Diversification

More portfolio weighting in B2B vs B2C businesses. We believe that in APAC, there are more business growth opportunities in engaging with business clients. In South Korea and other mature markets, we see more B2C opportunities due to strong spending power and advertising markets. In Southeast Asia, most B2C opportunities remain in platform businesses.

Southeast Asia

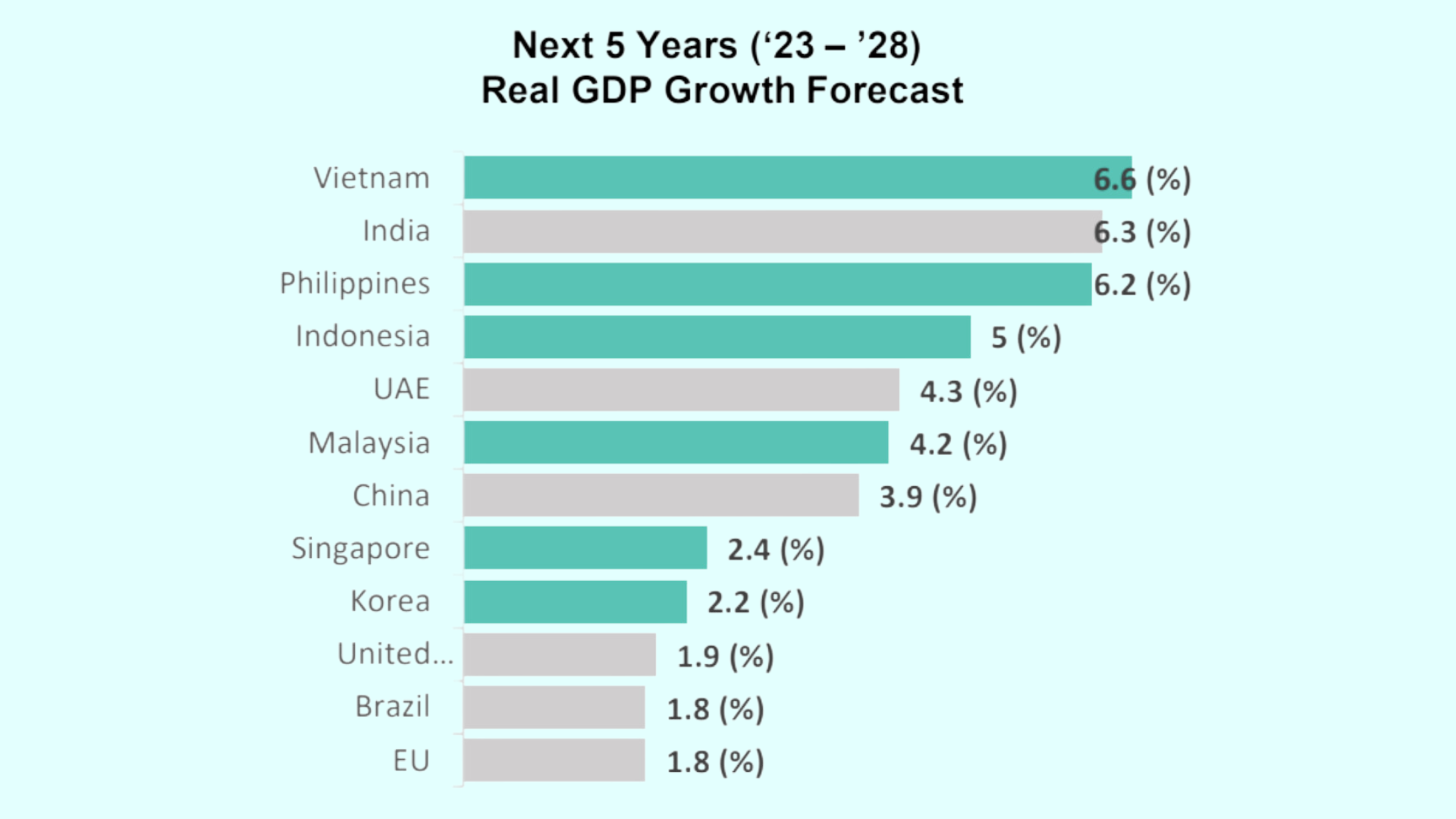

Macro Economy Expected Recovery. Southeast Asia’s GDP growth is forecast to keep up with the world’s fastest-growing economies.

South Korea

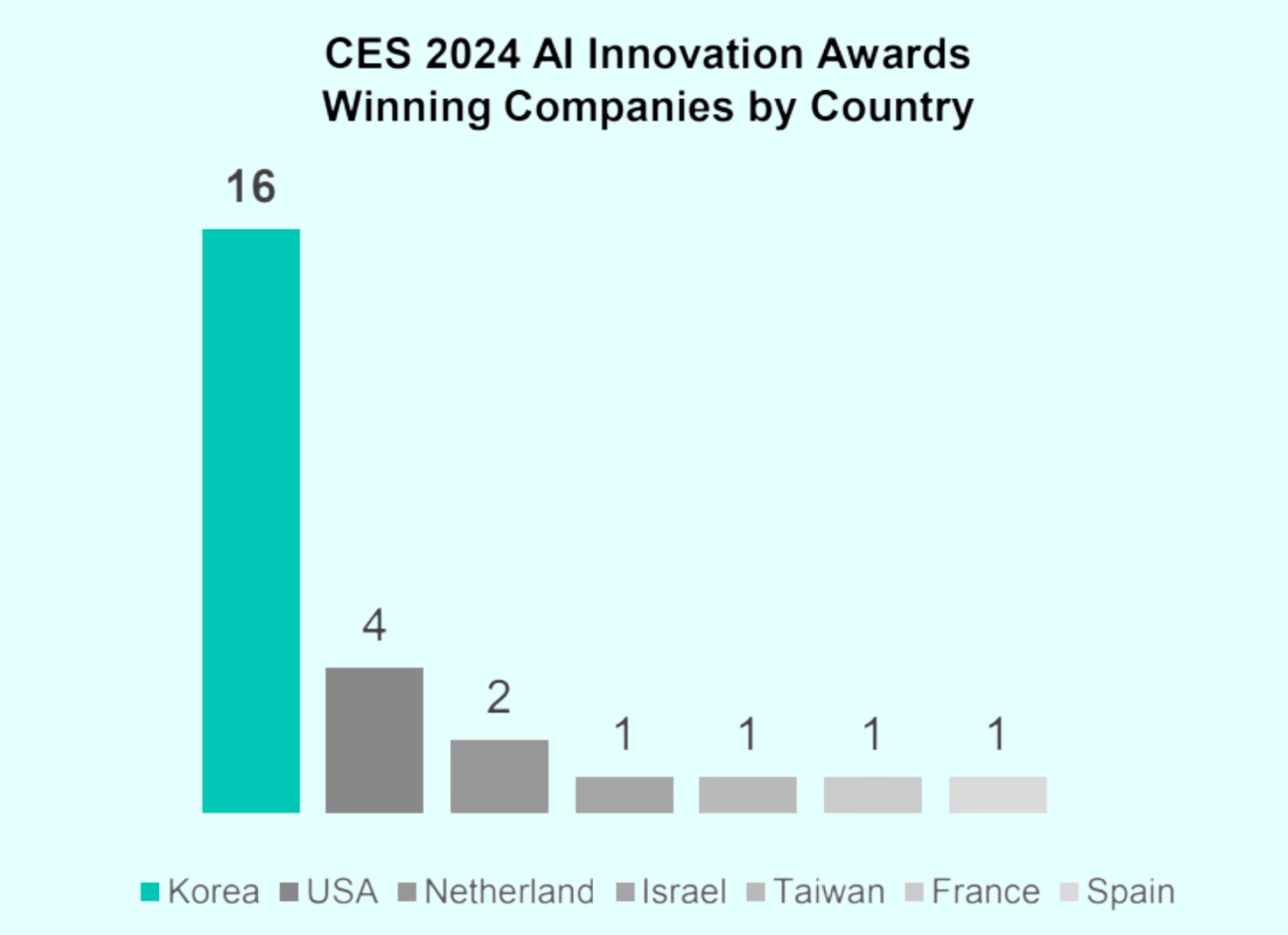

Remains a key investment destination for global investors.

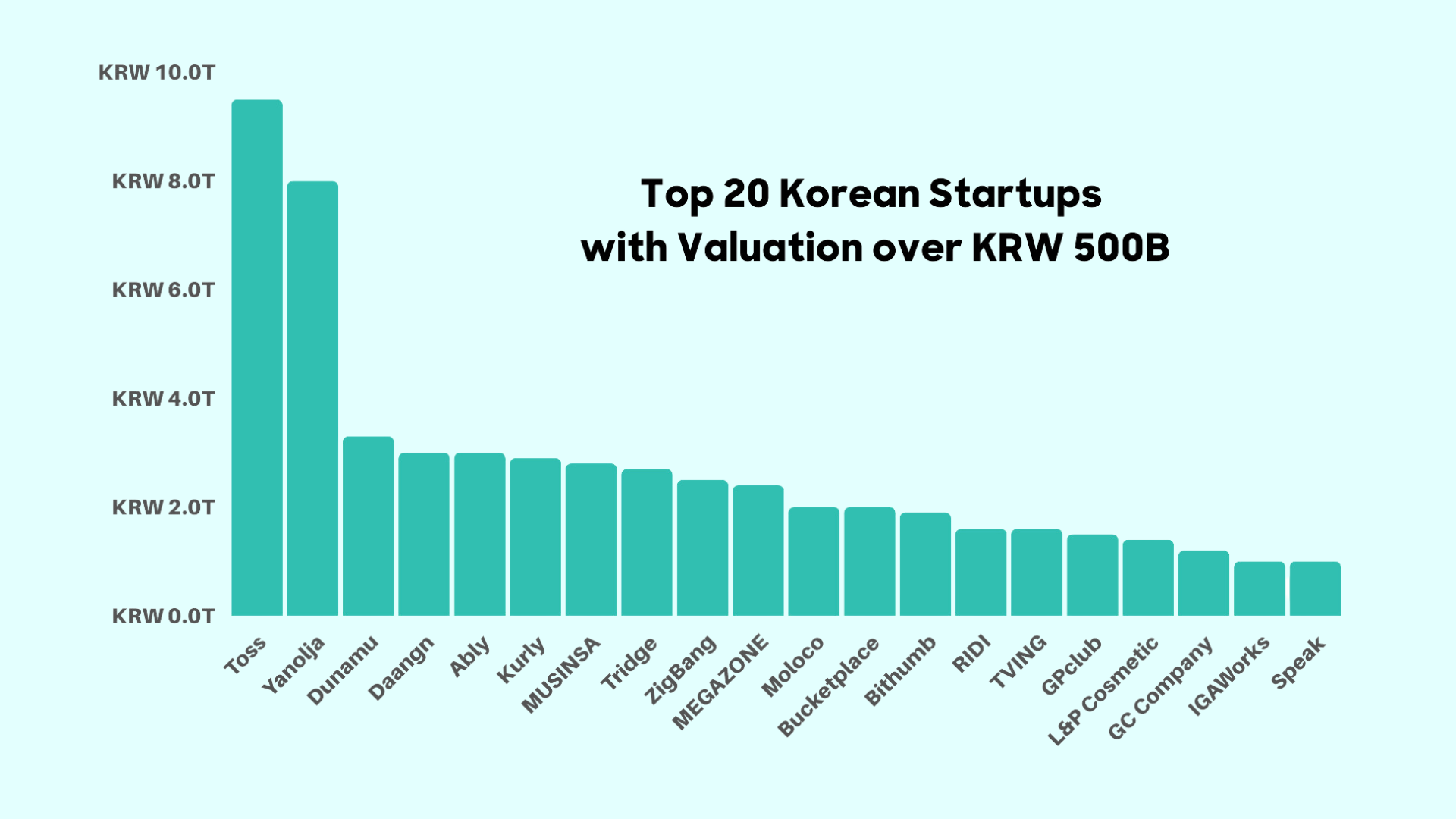

South Korea has had over 20 companies reach Unicorn status in the last 7 years, and an additional 40 that reached the $500 million mark. There will continue to be value opportunities for early-stage investors.

Key sectors of interest remain semiconductor, biotech, AI/blockchain, and mobility.

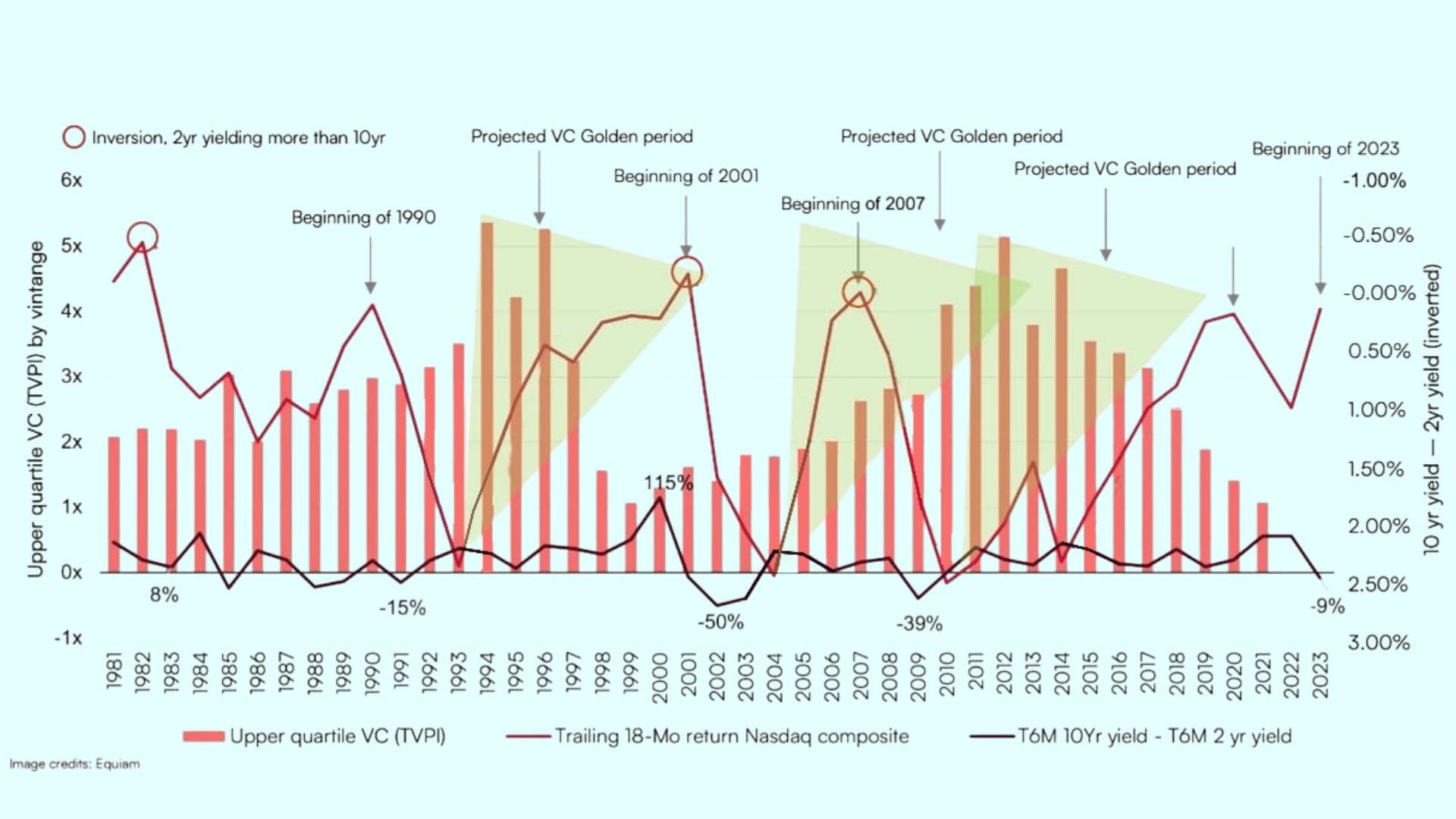

Currently Global Asset Values Deflated

Excellent Investment Timing

The current investment cycle provides excellent opportunities thanks to a shrinking competitive landscape and rational valuations.

History shows that we could be entering another Golden Period for venture capital, witnessed in previous recent down cycles.